The ‘Pause Life is now HSA/FSA Eligible!

Checking Out with Flex is Easy

HSA/FSA Payments With Flex

One-Time Purchases

1. Checkout

2. Complete Health Assessment

3. Make Your Purchase

Subscriptions

1. Make Your Purchase

2. Complete Health Assessment

3. Submit for Reimbursement

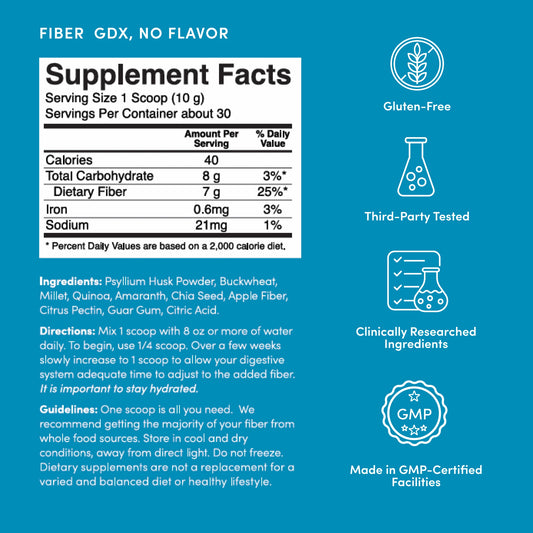

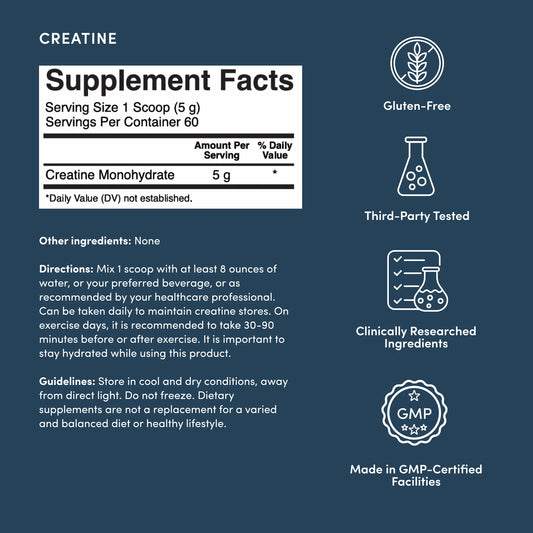

Eligible Products

Common Questions

- Understand your LMN

- Identify your HSA/FSA Administrator

- Log into your HSA/FSA Administrator’s Online Portal

- Locate the ‘Reimbursement’ or ‘Claims’ section

- Submit your LMN and Receipt

- Await Confirmation

- Repeat for future receipts